At its core, group travel insurance is a beautifully simple concept: one policy to protect everyone travelling together. Instead of each person sorting out their own cover, you get everything bundled under a single, easy-to-manage plan.

Think of it like organising a big dinner out. You could have everyone order and pay separately, leading to a mess of different bills and staggered food arrivals. Or, you could arrange a set menu for the whole table – simpler, often cheaper, and everyone gets what they need at the same time. That's what group travel insurance does for your trip. It cuts out the administrative headache and creates a single point of contact for the entire party.

How Does Group Travel Insurance Actually Work?

Picture this: you're trying to organise a trip for ten friends. If everyone buys their own insurance, you're left chasing ten different sets of paperwork, comparing ten different levels of cover, and hoping no one forgot. It’s a recipe for chaos.

Group travel insurance sidesteps that entire mess.

You purchase just one policy. That single policy then extends its protective umbrella over every person you list on it. This means everyone has the exact same level of cover, which is a massive relief when you're the one in charge. The insurer bundles the risk, which simplifies things on their end and, crucially, makes your life a lot easier.

The Financial Advantage of Going Group

The real magic behind group travel insurance is economy of scale. When an insurer sees a group, they don't see ten separate risks; they see one larger, more manageable one. This shared risk profile allows them to offer a lower price per person, and those savings get passed straight on to you. It's a classic win-win: the insurer has less admin, and your group gets a tidy discount.

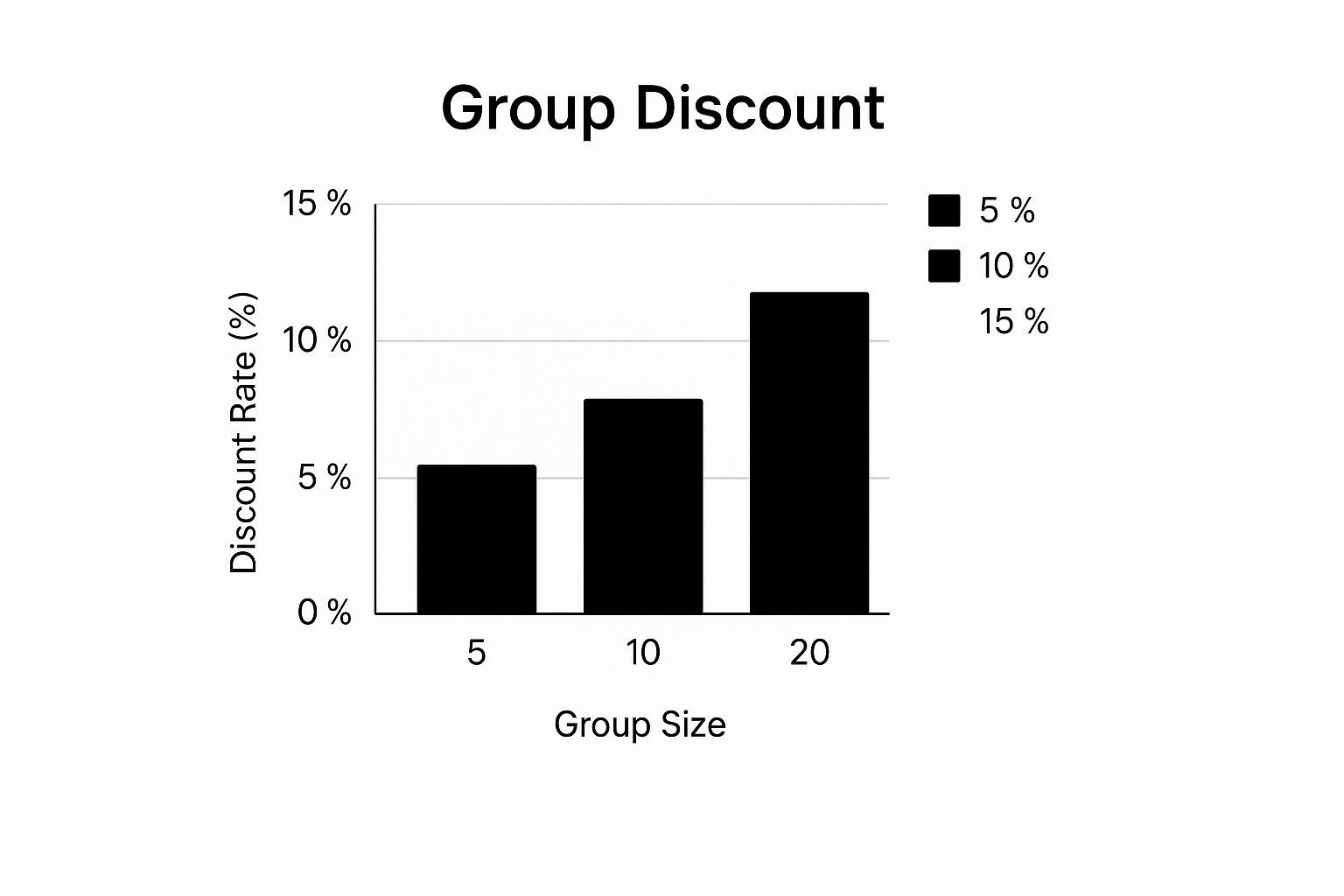

This cost-saving angle is a huge plus for anyone organising a trip, whether it’s for a family holiday, a sports team tour, or a company retreat. And the bigger the group, the better the savings tend to be.

As you can see, the more travellers you include, the greater the potential discount per person becomes.

And we're not talking about saving a few pennies here. The savings can be genuinely significant. For instance, data on travel insurance in the UK shows that while a solo traveller might pay an average of £17.90, that cost can drop to just £8 per person for groups of six or more. It proves that group policies aren't just convenient; they're the financially smarter choice for larger parties. For a deeper dive, you can explore more travel insurance statistics to see how the numbers stack up.

Individual vs Group Travel Insurance At a Glance

To make the choice clearer, here's a quick comparison of the two approaches.

| Feature | Individual Policy | Group Policy |

|---|---|---|

| Simplicity | Multiple policies to manage | One policy for everyone |

| Cost | Higher cost per person | Lower cost per person due to discounts |

| Coverage | Varies between individuals | Consistent cover for the whole group |

| Admin | High (chasing documents, multiple payments) | Low (one point of contact, one payment) |

Ultimately, a group policy is designed for coordinated travel, offering both financial and logistical benefits that individual policies simply can't match for a party travelling together.

How Are the Premiums Calculated?

So, how do insurers land on one price for a group of different people? They don't individually vet every single person. Instead, they calculate the premium based on the group's collective profile.

Here’s what they look at:

- Average Age: They'll consider the average age of all the travellers.

- Destination: Trips to countries with expensive healthcare, like the USA, will naturally cost more to insure.

- Trip Duration: The longer you're away, the more risk is involved, which is reflected in the price.

- Planned Activities: If your group is off on a ski trip or planning other adventurous sports, you'll need to add on specialist cover.

The policy's price reflects the group's overall risk profile, not just one individual's. This is why it’s a balanced and fair way to insure groups with varying ages and needs, ensuring everyone gets the right protection without complicated individual assessments.

The Real Benefits of Choosing Group Cover

While saving a bit of cash is always a welcome bonus, the true value of group travel insurance goes much deeper than your bank balance. The real game-changer is how it cuts down on stress and simplifies everything. It brings a sense of logistical harmony to your trip, which is often the first thing to go out the window when you’re trying to organise a group.

Just think about it: one policy to manage. That means one set of documents to keep safe, one renewal date to track (if it's an annual policy), and, crucially, one number to call if things don't go to plan. For whoever is organising the trip, this simplicity is a massive weight off their shoulders, turning a potentially chaotic job into something far more manageable.

The Power of One Unified Policy

Let me paint you a picture. Imagine Sarah, the head of the family, planning a big multi-generational holiday to Spain for her 70th birthday. She’s bringing her children, their partners, and a whole flock of grandchildren, with ages ranging from a seven-year-old to a 72-year-old.

If every family bought their own separate insurance, Sarah would be heading for a logistical nightmare. She'd be chasing up multiple documents, worrying if everyone actually remembered to get covered, and trying to figure out if all the policies were even comparable. One grandchild might have basic cover, while her son’s family went for a premium plan. This creates a real imbalance of protection within the same trip.

By choosing group travel insurance, Sarah avoids that headache completely.

- One simple transaction: She makes a single purchase that covers every single person.

- One set of documents: She gets one policy certificate to print or share digitally.

- One point of contact: If an issue comes up, everyone knows exactly who to call.

This centralised approach ensures nobody gets forgotten or accidentally ends up underinsured. It provides a consistent, equal level of protection for everyone on the trip, which delivers genuine peace of mind.

A single group policy acts as a safety net woven for the entire party, not just individuals. It guarantees that every traveller, from the youngest to the oldest, receives the same high standard of care and coverage, preventing dangerous gaps in protection.

Tailored Protection for Your Unique Adventure

Another fantastic benefit is the ability to shape the policy around your specific plans. If you look at standard policies from different insurers, you'll find they all have their own quirks and wildly different ideas of what’s included. A group policy lets you make sure the cover is a perfect fit for your itinerary.

Are you organising a company ski trip to the Alps? You can add winter sports cover for the whole team. Planning a school trip where students will be using valuable cameras for a media project? You can ensure there’s enough gadget cover for everyone. For those planning complex trips, having reliable transport is also key; you can explore options for group travel in London to ensure your party moves around the city smoothly and safely, complementing your insurance.

This ability to tailor the plan means you’re not just buying insurance; you're investing in protection that’s genuinely relevant to what your group will be doing. It takes the guesswork out of the equation and eliminates the risk of finding out too late that a key activity wasn't covered. You simply can't guarantee that level of specific, unified cover when everyone buys their own policy.

Ultimately, the benefits add up to create a far smoother and more secure travel experience. It’s about more than just money; it’s about making the entire process easier so you can focus on what really matters—enjoying the adventure with your group.

Who Can Get Group Travel Insurance?

It’s easy to think that group travel insurance is just for traditional family holidays. But that’s a common misconception. In reality, the idea of what makes a ‘group’ is far more flexible and modern than most people realise.

The main rule is refreshingly simple: you just need to be a group of people travelling on the same trip. This means leaving and returning on the same dates and generally sticking to the same itinerary. Once you’ve got that sorted, who is actually in your group can be incredibly varied.

Who Is Typically Eligible?

Forget the idea that you all have to be related or live at the same address. Insurers understand that today’s travel groups come in all shapes and sizes.

This makes group travel insurance a fantastic fit for all sorts of trips:

- Families and Extended Families: Perfect for those big multi-generational getaways with grandparents, cousins, aunts, and uncles all in tow.

- Groups of Friends: Whether you're heading to a festival, a city break, or just renting a villa together for a week in the sun.

- Sports Teams and Clubs: From a local football team heading to an away game to a rambling club exploring new trails.

- School, College, or University Trips: A straightforward way to cover students and their chaperones on educational tours.

- Corporate and Business Groups: Ideal for team-building retreats, conferences, or reward trips. If you're planning a business trip, our guide on corporate travel tips has some great advice for making it a success.

- Special Interest Groups: Think of a photography club on a scenic expedition or a history society visiting ancient ruins.

As you can see, the list goes on. The key thing to remember is that the shared travel schedule is what truly matters, not how you all know each other.

Navigating Age Ranges and Medical Conditions

One of the biggest headaches for any trip organiser is dealing with a mix of ages and individual health needs. This is where group cover really shines. Insurers have this down to a fine art.

During the application process, you’ll need to provide the ages of everyone in the group and declare any pre-existing medical conditions for each person. The insurer then looks at the group as a whole to calculate a single premium. This is a game-changer, as it means older travellers or those with health issues don’t have to hunt for separate, often expensive, specialist policies.

It’s a bit like creating a balanced average. The lower risk from younger, healthier travellers helps to offset the higher risk from older members or those with minor conditions. The end result is usually a much fairer price for everyone involved.

This streamlined approach means everyone gets the same level of protection under one policy, no matter their personal situation. It’s one of the core reasons group policies are so practical and popular.

This affordability is a huge draw for younger people. Millennials, who are the biggest buyers of travel insurance in the UK, often travel with friends to festivals or on city breaks where keeping costs down is vital. It’s also why group cover is a go-to for seniors planning holidays together. You can dive deeper into these trends with travel insurance statistics from Condor Ferries.

Understanding Your Coverage Options

When you take out group travel insurance, what are you actually paying for? A good policy is a bit like a well-stocked first-aid kit; it should have everything you’ll need for common mishaps, plus a few specialist items for your specific type of journey. Getting to grips with the core components helps you see the real value, which goes far beyond just the price tag.

Most policies are built on a solid foundation of standard cover that protects against the most frequent travel headaches. Think of these as the non-negotiables—the things that provide a robust safety net for your entire group, no matter where your travels take you.

Standard Cover: The Essentials

At its heart, any group travel insurance policy is designed to shield you from major financial shocks. You’ll find that the core coverage areas are remarkably consistent across most reputable UK providers, and for good reason.

These are the absolute essentials you should expect to see:

- Medical Emergencies: This is, without a doubt, the most critical part of any policy. It covers the costs for emergency medical and dental treatment, hospital stays, and—if it’s medically necessary—getting you back home. Cover often runs into the millions, which is crucial when you realise just how astronomical overseas medical bills can be.

- Trip Cancellation: If your group has to call off the trip for a covered reason (like a sudden illness, family bereavement, or being called for jury service), this part of the policy reimburses you for non-refundable costs like flights, accommodation, and pre-booked excursions.

- Lost or Stolen Baggage: This provides compensation if your luggage, personal belongings, or important travel documents are lost, stolen, or damaged during your trip. It’s worth noting that there are usually per-item limits, so always check the small print.

- Personal Liability: This is your protection if you accidentally injure someone or damage their property while on holiday. It covers the legal expenses and any compensation you might be required to pay.

These core features are there to handle the big, costly “what ifs” that can quickly turn a dream holiday into a financial nightmare. A solid policy ensures your group is never left exposed.

Remember, the primary goal of travel insurance is to prevent a mishap from becoming a crisis. A cancelled flight is an inconvenience; having to pay for new flights for ten people out-of-pocket is a disaster. This is the protection that truly matters.

Tailoring Your Policy with Optional Extras

While standard cover is absolutely essential, we all know that not all trips are created equal. This is where insurers offer optional add-ons, allowing you to build a policy that perfectly matches your group’s specific itinerary. This à la carte approach ensures you only pay for the protection you actually need.

Think of it like adding toppings to a pizza. The base is your standard cover, but the extras are what make it just right for your group.

Below is a quick overview of some common coverage options you'll encounter.

Common Group Travel Insurance Coverage Options

| Coverage Type | What It Typically Covers | Best For Which Groups |

|---|---|---|

| Winter Sports | Piste rescue, lost or damaged equipment, unused ski pass costs due to injury or resort closure. | Groups heading to the slopes for skiing or snowboarding. |

| Gadget Cover | Specific protection for high-value tech like smartphones, laptops, and cameras against theft, loss, or damage. | Tech-savvy groups, photographers, or business travellers. |

| Cruise Cover | Missed port departures, cabin confinement due to illness, unused excursions, and itinerary changes. | Any group embarking on a cruise holiday. |

| Business Cover | Protection for essential business equipment and funds to send a replacement colleague if a key person can't travel. | Corporate teams travelling for work, conferences, or meetings. |

Choosing the right add-ons is the key to making sure there are no nasty gaps in your protection. For a comprehensive look at how these elements come together, our detailed guide on travel insurance for large groups explains how to build the perfect policy for your team.

This ability to customise is a huge benefit. Research shows that while a single-trip policy might average around £21.36, opting for group cover can slash this cost by over 60% per traveller. This saving makes it much more affordable to add the specific extras your group requires without breaking the bank.

How to Select the Right Group Policy

Choosing the right group travel insurance can feel a bit like navigating a maze, but it doesn't have to be overwhelming. With a bit of know-how, you can confidently pick a policy that gives everyone proper protection and real value. The secret is to look beyond the headline price and dig into what your group actually needs for this specific trip.

I always tell people to think of it like buying a new coat. You wouldn't just grab the cheapest one on the rack, would you? You’d check if it's genuinely waterproof, warm enough for where you're going, and has the right pockets. Selecting a group policy is exactly the same—it’s all about matching the cover to your group's unique situation.

Assess Your Group's Unique Profile

First things first: before you even start looking at quotes, you need to do a bit of homework on your group and the trip itself. This initial prep work is absolutely vital. Insurers need these details to give you an accurate price and, more importantly, to make sure your cover is valid from the get-go. Skipping this step now will only cause headaches later.

Start by pulling together this key information from every single traveller:

- Full Names and Dates of Birth: This is the basic foundation for identifying everyone on the policy.

- Pre-existing Medical Conditions: You have to declare absolutely everything. Being anything less than 100% honest here could invalidate the entire policy, leaving everyone in your group completely exposed if something goes wrong.

- Destination(s): Where are you headed? Cover for a jaunt to Europe is priced very differently from a trip to the USA or a round-the-world adventure.

- Trip Dates: The policy needs to cover you from the day you set off to the day you get back home.

- Planned Activities: Are you thinking of skiing, scuba diving, or even just a bit of quad biking? These kinds of activities are rarely covered as standard and usually need a specific add-on.

Getting all this information ready makes the whole quoting process much smoother and means you're comparing apples with apples.

Compare Policies Like a Pro

Once you have your group’s details organised, you can dive into comparing policies. While price is obviously a factor, it’s only one part of the equation. A cheap policy with a sky-high excess or low coverage limits can end up costing you a fortune if you actually need to make a claim.

To find the best value, you need to focus on these crucial details:

-

Check the Coverage Limits: At a bare minimum, look for £5 million in medical emergency cover for Europe and £10 million for worldwide travel. Don't forget to check the limits for cancellation and baggage, too—is it enough to cover what you all paid for the trip and the value of your stuff?

-

Understand the Excess: The excess is simply the amount you have to pay towards a claim before the insurer chips in. A lower premium often goes hand-in-hand with a higher excess. Just make sure it’s an amount you’d all be comfortable paying out of pocket.

-

Read the Exclusions: This is where so many people get caught out. Buried in the policy document is a list of things that aren't covered. Common exclusions include incidents involving too much alcohol or, as mentioned, undeclared medical conditions.

The real test of a good policy isn't its price, but its performance when you need it most. Prioritise a policy from a reputable underwriter with strong customer reviews over one that is merely the cheapest option available.

By taking this methodical approach, you can easily cut through the marketing noise and find a group travel insurance policy that gives your entire party the protection and, ultimately, the peace of mind they deserve.

Common Mistakes to Avoid When Buying Group Cover

We’ve all been tempted by the cheapest option, but when it comes to travel insurance, that’s a shortcut that can quickly become an expensive mistake. Choosing the right group policy means navigating a few common pitfalls that can catch out even the most organised trip leader. Getting your head around these potential errors is the best way to secure a policy that actually protects you when it matters most.

One of the most frequent slip-ups is underinsuring your trip’s total cost. It’s easy to just add up the flights and hotel bill and call it a day. But what about those concert tickets you pre-booked, the guided tours, or the car hire deposit? If you have to cancel for a valid reason, you can only claim for the value you insured, which could leave a big hole in your group's finances.

Failing to Declare Everything

Another critical oversight is not declaring every single pre-existing medical condition for every single person in the group. It might feel like a minor detail, but for an insurer, it’s a deal-breaker. Even something that feels completely under control, like stable high blood pressure, absolutely must be declared.

If a claim comes up that’s even remotely connected to an undeclared condition, the insurer is well within their rights to void the policy for that person. In some cases, it can even affect the whole group. Honesty and full transparency aren't optional here.

Assuming Activities Are Covered

Never, ever assume that your adventurous plans are covered by a standard policy. Picture this: your group spontaneously decides to go jet-skiing, or maybe you book a quad biking tour. If someone has an accident, you could get a nasty shock when you realise your policy specifically excludes what it calls "hazardous" activities.

Here are a few common assumptions you’ll want to steer clear of:

- Assuming all sports are included: A basic policy usually won't cover much more than a leisurely swim. Activities like skiing, scuba diving, and even trekking at high altitudes will almost certainly need a specialist add-on.

- Assuming one person’s details are enough: Each person travelling has to declare their own medical history accurately. The health of one traveller is no reflection of the entire group's needs.

- Assuming the cheapest policy is the best value: The best policy is the one that gives you the right cover for your trip, not just the one with the lowest price tag. Always check the excess amounts and the coverage limits before you buy.

Ultimately, dodging these mistakes all comes down to being diligent. If you’re thorough and honest from the very beginning, you can make sure your group has solid protection. That means no financial headaches down the line and the freedom for everyone to travel with real peace of mind.

Frequently Asked Questions

It’s completely normal to have a few questions when you’re sorting out group travel insurance. Getting your head around the details is the best way to make sure you’ve chosen the right cover and can relax, knowing everyone is protected. Let's walk through some of the most common things people ask.

The fundamental idea behind a group policy is that you're all on the same adventure. Because of this, sticking to the same travel plan is nearly always a condition of the cover.

Do We All Have to Travel on the Same Dates?

In a word, yes. The main reason group travel insurance is so straightforward and cost-effective is that it's built on the assumption that everyone departs and returns together. Think of your shared itinerary as the foundation of the policy.

While you might find an insurer who allows a little wiggle room in a true emergency, you shouldn't count on it. It’s always best to assume the dates must match for everyone. If you have any doubts, have a direct chat with the provider before you buy.

What Happens If One Person Has to Cancel?

This is where a group policy really shows its value. If someone in your party has to pull out for a reason covered by the insurance – like an unexpected illness – the policy should reimburse their share of any non-refundable costs.

That means the rest of you can carry on with your holiday without being left out of pocket. In some specific situations, if the person cancelling is critical to the trip (imagine the only qualified driver on a minibus tour), you might even be able to claim for the cancellation of the entire holiday. This, however, depends on having a specific 'trip disruption' clause in your policy, so always check the small print.

A huge plus for group cover is that one person's bad luck doesn't have to torpedo the holiday for everyone else. The policy is smart enough to handle individual problems within the group, letting the trip go ahead for the remaining travellers.

How Do Claims Work on a Group Policy?

Even though it’s a single policy covering everyone, claims are always handled individually. This keeps everything organised and fair.

So, if one person needs to see a doctor or has their bag stolen, they are the one who makes the claim for their specific loss. The beauty of this is that all claims go to the same insurer under one policy number, which really cuts down on the hassle and paperwork. But the claim itself, and any money paid out, belongs to the person who was affected.

Is There a Limit on How Many People Can Be in a Group?

The maximum number of people you can insure on one group policy really depends on the provider. It's something you'll need to check before you start comparing quotes.

As a rough guide:

- Standard Policies: Most insurers you find online can easily cover groups of up to 10 or 12 people.

- Larger Groups: For bigger parties – think school trips, sports teams, or company outings – you’ll probably need to go to a specialist insurer or a broker. They can put together custom-made policies for groups of 50 or more.

My advice? If you're organising travel for a large group, just pick up the phone and speak directly to an insurance provider. They can work with you to build a plan that properly covers every single person.

Once you’ve got the insurance sorted, getting your group from A to B is the next big task. West London Minibus Hire provides reliable and comfortable minibus hire with a professional driver, making sure your whole party travels together safely and on time. Whether it's an airport run, a corporate day out, or a special event, we've got you covered. Get your no-obligation quote today at westlondonminibushire.com.